2017 - 17th Edition

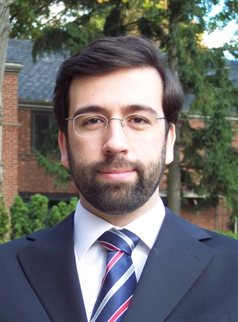

BENJAMIN MOLL

The 2017 Bernácer Prize has been awarded to Professor Benjamin Moll (Princeton University) for his path-breaking contributions to incorporate consumer and firm heterogeneity into macroeconomic models and use such models to study rich interactions between inequality and the macroeconomy.

2016 - 16th Edition

2015 - 15th Edition

2014 - 14th Edition

VERONICA GUERRIERI

The Bernácer Prize was awarded this year to Prof. Veronica Guerrieri (The University of Chicago Booth School of Business)

"for her influential research contributions regarding the application of search theory to explain the emergence of illiquidity and fire sales in different asset markets."

2013 - 13th Edition

2012 - 12th Edition

2011 - 11th Edition

Lasse H. Pedersen

The Bernácer Prize was awarded to Prof. Lasse H. Pedersen (Copenhagen Business School and NYU Stern School of Business)

"for his original research contributions on how the interaction between market liquidity risk and funding liquidity risk can create liquidity spiral and systemic financial crisis"

2010 - 10th Edition

XAVIER GABAIX

The 2010 Bernácer Prize was awarded to Xavier Gabaix (NYU Stern School of Business)

"for his original research contributions in financial and behavioural economics, including the consequences of seemingly irrational behaviour on asset markets, and his analysis of the level of compensation of corporate executives"

2009 - 9th Edition

Emmanuel Farhi

The 2009 Bernácer Prize was awarded to Prof. Emmanuel Farhi (Harvard University)

"for his relevant contributions to the design of optimal taxation in business cycle models with incomplete markets, and for improving our understanding of the macroeconomic mechanisms that underlie the relationships among global imbalances, financial crashes, speculative growth episodes and real activity"

2008 - 8th Edition

Markus Brunnermeier

The Bernácer Prize was awarded to Prof. Markus Brunnermeier (Princeton University)

"for his important research on explaining the emergence and persistence of asset price bubbles, the causes of liquidity crises in financial markets, and the implications of these phenomena for risk management and for financial regulators"

2007 - 7th Edition

Pierre-Olivier Gourinchas

The Bernácer Prize was awarded to Prof. Pierre-Olivier Gourinchas (University of California, Berkeley)

"for his important research on explaining recent (puzzling) facts in global macroeconomics and finance, evaluating the gains of financial integration and analyzing the importance of precautionary saving in optimal life--cycle models of consumption expenditure in the presence of uncertain labour income"

2006 - 6th Edition

HÉLÈNE REY

The Bernácer Prize was awarded to Hélène Rey (London Business School)

"for her important research on the determinants and consequences of external trade and financial imbalances, the theory of financial crisis and the internationalization of currencies. Her contributions help to improve our understanding of the connections among globalization, exchanges rates and external markets"

2005 - 5th Edition

Monika Piazzesi

The Germán Bernácer Prize was awarded to Prof. Monika Piazzesi (Stanford University)

"for her important research in developing a unified approach that improves our understanding of the connection between asset prices- including bonds, equities and real estate- and the institutional features of monetary policy and the business cycles"

2004 - 4th Edition

STEPHANIE SCHMITT-GROHE

The Germán Bernácer Prize was awarded to the German economist Stephanie Schmitt-Grohe (Columbia University)

"for her important research devoted to developing and applying the tools for evaluation of macroeconomic (fiscal and monetary) stabilization policies in the context of economies subject to nominal and real distortions."

2003 - 3th Edition

2002 - 2nd Edition

2001 - 1st Edition

CALL FOR NOMINATIONS FOR THE 2015 BERNACER PRIZE

The 14th edition of the Bernácer Prize is launched. Nominations for the Bernácer Prize must be received by 31, October 2015.

The Bernácer Prize is awarded annually to European economists under the age of 40, who have made outstanding contributions in the fields of macroeconomics and finance.